TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,608

- Points

- 298

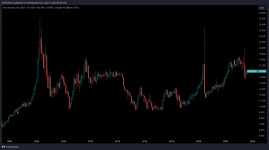

Panic buying in Rice, today is Nat Gas, Oil and Gasoline both very strong lately, even the Softs with some strong Up and Downs.... PM"s however still managing to be controlled. It all screams inflation is FAR from dead.

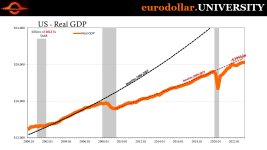

Price rises are far from over... and that maybe the case in the primary sector. Regardless all the data is telling us the monetary deflation is in process. The secondary sector and the tertiary sector are having thier margins squeezed from both ends. You simply can't equate price rises with inflation. There are so many other factors at play here.

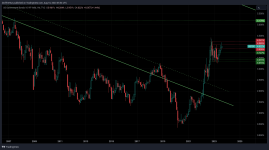

If you are going to focus on price why not look at PPI globally, everyone I have seen is declining.

This is the reason they muddied the water around the term inflation. It completely destroys your ability to analyse the situation correctly if you equate inflation with price rises.

So yeah, we may will see price rising rapidly in certain areas as a part of some sort of second wave but it's not happening for the same reasons it happened in the 70s.