I guess the caveat to that is money supply measured against real growth in demand/need for a bigger/smaller pool of dollars. AKA, What is the neutral point in terms of money supply for a growing or shrinking economy. Is the money supply at the moment just shrinking along with the shrinking real demand for it. I don't know, and I don't see that we can ever determine what that neutral point really is. We simply don't have those numbers, at least not ones I'd trust.

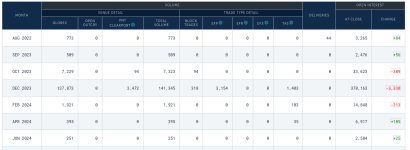

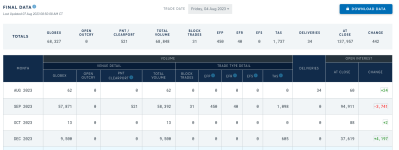

The Reverse Repo numbers are declining significantly and Rafi thinks those are being used to soak up at least a decent amount of the new Treasury debt. Pretty sure that will shrink M2. At least all the people moving money out of checking accounts and into money markets / CD's.